Table of Contents

- Introduction to Accounts Receivable Management

- Importance of Streamlining Processes

- Implementing Technology in Financial Systems

- Effective Communication with Clients

- Maintaining Accurate Financial Records

- The Role of Training and Development

- Setting Clear Payment Terms and Policies

- Frequently Asked Questions about Accounts Receivable Management

Introduction to Accounts Receivable Management

Accounts receivable management is a cornerstone of business operations, critically influencing a company’s financial health and operational continuity. The process encompasses tracking, verifying, and collecting payments owed by customers, which is pivotal in ensuring a positive cash flow necessary for sustaining daily operations and supporting future expansion strategies. The landscape of accounts receivable is fraught with challenges, including billing inaccuracies, delayed payments, and resource-intensive administrative tasks that can impede a company’s growth and resilience. Many businesses consider accounts receivable outsourcing an effective strategy in response to these challenges. This approach enables companies to tap into expert knowledge and state-of-the-art technology, achieving higher efficiency, lowering operational costs, and improving the rate of payment collections, thereby fostering a more robust financial ecosystem that underpins sustained business success and growth.

Importance of Streamlining Processes

Streamlining accounts receivable processes is essential for any business aiming to enhance its financial hygiene and operational efficiency. This entails simplifying and optimizing workflows to ensure high accuracy, reduce transactional friction, and accelerate cash inflow, which is vital for meeting immediate financial obligations. A streamlined process involves timely issuance of invoices, efficient tracking of due payments, and prompt resolution of discrepancies, thus minimizing potential delays that can trigger cash flow disruptions. Companies that distill complex processes into well-defined and manageable frameworks often witness enhanced productivity, reduced operational costs, and sustainable growth, solidifying their market position. For smaller enterprises, in particular, this efficiency translates into a competitive advantage, as it allows them to devote more resources to core activities like innovation and customer engagement, propelling their market standing and growth.

Implementing Technology in Financial Systems

The role of technology in transforming accounts receivable management is profound and indispensable. Automation tools and digital financial platforms, such as sophisticated billing software, invoice automation solutions, and seamless electronic invoicing systems, have redefined how businesses conduct their financial operations, ushering in an era of precision, speed, and enhanced customer interactions. These technologies alleviate the burden of manual operations, significantly reducing human errors and enhancing the accuracy and speed of processing invoices and payments. The introduction of cloud-based financial solutions provides businesses unparalleled flexibility and real-time access to financial data, empowering decision-makers to analyze, strategize, and act promptly based on actionable insights. The enhanced efficiency and customer satisfaction derived from such digital advancements are not mere trends but foundational shifts driving the modern business landscape toward greater agility, transparency, and client-centric engagement.

Effective Communication with Clients

Efficient and transparent communication with clients is indispensable for successful accounts receivable management. Establishing dedicated, reliable communication channels can significantly enhance payment collection rates and strengthen client rapport, leading to more robust business relationships. This involves implementing personalized follow-ups, transparent invoicing mechanisms, and timely notifications regarding upcoming payments, ensuring clients are well-informed of their obligations and responsibilities. Regular dialogues provide a platform for addressing misunderstandings or discrepancies before they escalate, minimizing the risk of disputes and late payments. Companies that put communication at the forefront foster trust and reliability among their client base and cultivate a collaborative business environment that drives long-lasting partnerships and financial stability.

Maintaining Accurate Financial Records

Accurate financial record-keeping is the backbone of efficient accounts receivable management, critical in ensuring seamless operations and regulatory compliance. This process involves the detailed documentation and verification of all financial transactions, including invoices issued, payments received, and any anomalies encountered during operations. Proper bookkeeping not only aids in maintaining transparency with stakeholders but also enables businesses to track outstanding payments efficiently, facilitating better cash flow management. Implementing advanced financial management software can further elevate the accuracy and efficiency of record-keeping by minimizing human error and automating routine tasks. These records are crucial for financial analysis, strategic planning, and forecasting, as they offer insights into the business’s financial health and performance over time. Companies prioritizing meticulous record maintenance are invariably better positioned to manage their fiscal responsibilities proactively, identifying trends and potential issues before they evolve into significant challenges.

The Role of Training and Development

Ongoing training and development are pivotal in elevating the efficiency and effectiveness of accounts receivable operations. Continuous learning opportunities equip employees with the latest skills and knowledge to navigate the rapidly evolving financial landscape and handle complex transactions with expertise and confidence. The Society for Human Resource Management underscores the importance of cultivating a culture of continuous learning within organizations, highlighting that it dramatically enhances employee engagement, morale, and performance. By ensuring that employees are adept with the latest industry practices and technologies, businesses can enhance their financial operations’ accuracy, efficiency, and scalability. A well-trained workforce ultimately contributes to more accurate billing, improved collections, and a robust financial management strategy, bolstering the organization’s competitiveness and market success.

Setting Clear Payment Terms and Policies

Setting clear and defined payment terms and policies is a fundamental strategy for ineffective accounts receivable management, serving as a blueprint for financial transactions and client interactions. Clearly defined terms around billing, payment deadlines, accepted payment methods, and penalties for late payments establish expectations and promote a structured approach to financial dealings. Transparent communication of these policies aligns the business and its clients, mitigating misunderstandings and fostering a climate of transparency and mutual accountability. By outlining these policies from the beginning of the partnership, businesses can ensure steady cash flow, reduce incidences of overdue payments, and enhance future financial predictability. Structured, well-communicated agreements facilitate more effective financial planning and management for the business and promote trust and professionalism in client relationships, reinforcing the organization’s reputation for reliability and integrity.

Frequently Asked Questions about Accounts Receivable Management

This section addresses common inquiries to provide further clarity and insights into the effective management of accounts receivable:

- What is the impact of delayed payments? – Delayed payments can significantly disrupt a business’s cash flow, affecting its ability to fulfill financial obligations, invest in growth opportunities, and sustain operational effectiveness over time.

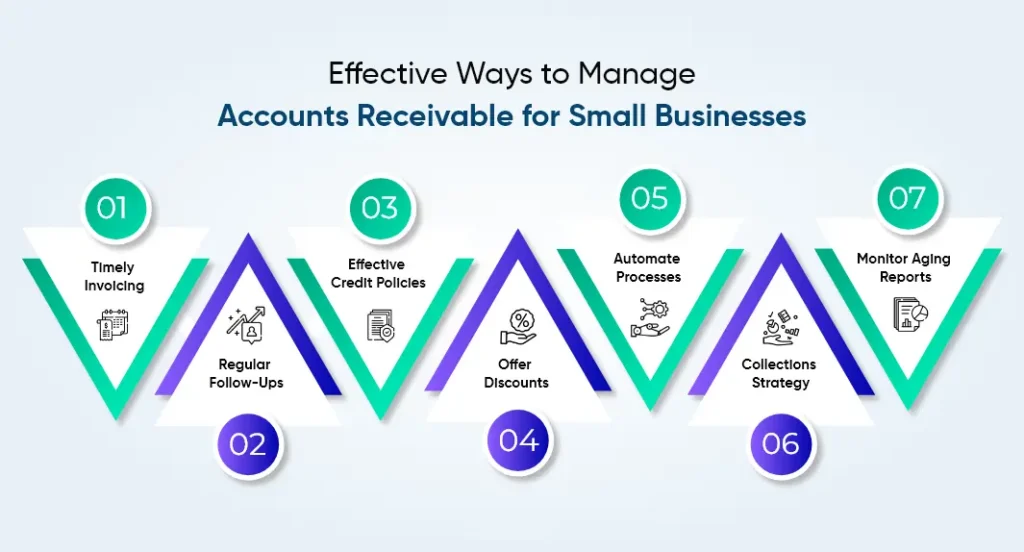

- How can small businesses improve their receivable processes? – Small businesses can optimize their receivables by leveraging automated invoicing systems, maintaining open and consistent communication with clients, and employing professional collection services when necessary to ensure timely payments.

- Why is client relationship management critical? – Strong client relationships foster trust and improve the ability to negotiate payment terms, leading to more reliable and timely payments and promoting long-lasting, sustainable business partnerships.